Blink and you'll miss it: what the budget did for working mums

Miranda Stewart, University of Melbourne

Working mothers get something in the budget, but not much, and not for long.

Before the budget the second earner in a couple with young children (usually the mother) lost almost all of the income she made working for the second, third, forth and fifth days per week.

It might be why many mothers work only one or two days per week.

After the budget tax cuts and one-year extension of the low and middle income tax offset that mother will lose slightly less on the third, forth and fifth days.

Our calculations of what will be lost prepared with former Department of Social Services analyst David Plunkett take into account the extra earnings for each extra day worked, the extra childcare costs at the average fee net of subsidy, the extra income tax charged, the imposition of the Medicare levy after the second or third day of paid work, and the family tax benefits lost.

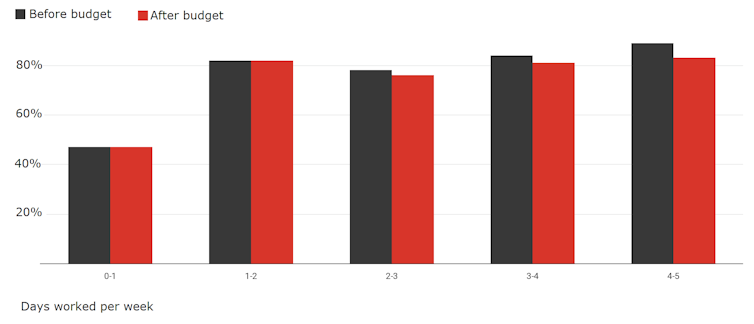

We find that before the budget a second earner on the median female wage of $190 per day with a partner on the median male wage and two children in long day care, lost a hefty 47% of what she earned on the first day per week.

On subsequent days her losses almost doubled.

Read more: Mothers have little to show for extra days of work under new tax changes

She lost 82% of what she earned on second day, 78% of what she earned on the third day, 81% of what she earned on the forth day and an extraordinary 89% of what she earned on the fifth day.

After the budget tax changes, her losses for the first and second days remain unchanged, and her losses for the third, forth and fifth day change little, slipping to 76%, 81% and 83%.

Percentage of additional earnings lost to taxes, transfers and child care costs

Second earner, before and after budget tax cuts and offset extension

The bulk of the modest easing in the penalty for working comes from the extension of low and middle income tax offset.

But the budget extended it for only one year, meaning that after one year the high effective marginal tax rates will spring back to near where they were.

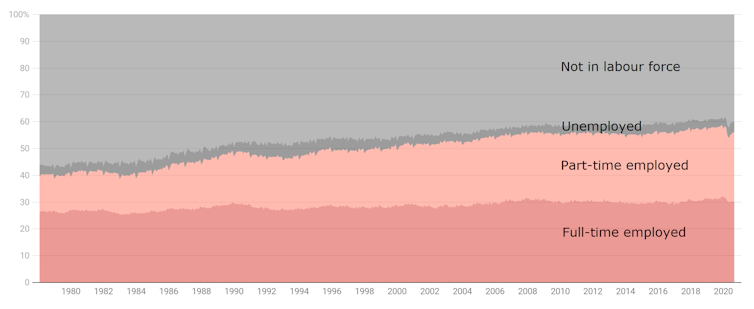

The high penalty makes it less surprising that the proportion of Australian women working full-time has climbed little in four decades.

Proportion of women employed

Expressed in terms of dollars kept by such a worker we find that on the first day she will keep $100.33 of her $190.

On the second day she will keep only $35.65, and by the fifth day only $31.38.

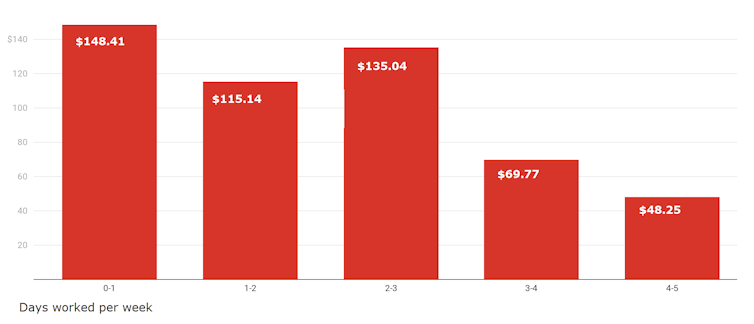

Net gain per day worked by second earner on $190, median female wage

Examining the position of a much-higher earning second worker on the average female wage of $293.82 per day with partner on the average male wage, we find that on the first day she will keep $148.41 and by the fifth day only $48.25.

Net gain per day worked by second earner on $293.82, average female wage

Single parents face extremely high effective tax rates, even though government policy is meant to encourage them to enter the paid workforce.

A single parent on the average female wage of $76,000 actually goes backwards on Day 4 as she loses her parenting payment, wiping out altogether the benefit of moving from three to five days a week.

The tax changes announced in the budget don’t solve the problem.

Net gain per day worked by single parent on $293.82, average female wage

The Minister for Education says out-of-pocket childcare costs are less than $5 per hour per child for the parents of three quarters of children in care, and less than $2 per hour per child for parents of the remaining one quarter.

But set against the hourly wages of second earners and accompanied by the withdrawal of benefits, the costs are substantial – so much so that only 45% of children under the age of five are cared for in childcare centres.

Different families cope in different ways

Facing high effective marginal tax rates of 80% when the statutory marginal tax rate (including the Medicare levy) is meant to top out at 47%, different families cope in different ways.

In some, the mum goes back to work full time and the dad stays at home or works part time, sometimes facing workplace discrimination.

Others rely on grandparents.

In many more, the mother doesn’t work. Fewer than two thirds of mothers with children aged under five are in paid work, compared with 95% of dads.

Of those who are in paid work, 60% are part-time, compared to only 7% fathers.

When their children get to school, half of these mothers continue to work part-time, and many stay part-time as children grow older.

Yet women account for half of our population and more than half of our University graduates.

Labor promises more, but not enough

Those staying out of the paid workforce lose income, human capital, skills, superannuation, and a connection to the labour market.

Without economic independence they are poorer and more vulnerable to domestic violence.

In his budget reply speech opposition leader Anthony Albanese promised to remove the annual cap on the childcare subsidy, to subsidise up to 90% instead of 85% of the hourly fee and to withdraw the subsidy more gradually as incomes climb.

These measures would help, but they don’t go far enough.

What would really help is free childcare for children under five and free before-school and after-school care for children up to age 12.

For a short time, the COVID response showed us what could be done.

There’s a precedent for free childcare

For three months from March childcare become free, eliminating much of the financial penalty for work.

If we kept it free and got rid of the exceptionally high penalties for working we could more properly use the skills of women, those women and their families could enjoy more financially secure lives and we might even nudge up the birth rate.

It has fallen to 1.69 children per woman, below replacement. For far too many women, having children and returning to work isn’t paying.![]()

Miranda Stewart, Professor, University of Melbourne

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Jobs Just For You, The HR Professional

Our weekly or daily email bulletins are guaranteed to contain only fresh employment opportunities

Latest Jobs

People Implementation Lead - Contract

New South Wales

Talent Acquisition Coordinator - Contract

Queensland

Blue Collar Recruiter - Contract

Western Australia

Organisational Safety Manager

Queensland

Workers Compensation Manager - Contract

New South Wales

HR Administrator

Western Australia

HR Advisor - Contract

New South Wales

People Risk & Compliance Advisor

New South Wales

HR Business Partner

Western Australia

HR Business Partner

Western Australia

HR Advisor- Temporary until end March 2026 - Contract

South Australia

Employee Relations Team Leader

Western Australia

FIFO Senior HR Advisor - Contract

Western Australia

HR Advisor - Contract

Western Australia

HR Advisor - Contract

Western Australia

Blue Collar Recruitment Advisor - Contract

Western Australia

Senior HR Leader

Western Australia

Rostering Partner - fully remote contract

New South Wales

HR Generalist - Contract

Victoria

HR Advisor - Contract

Western Australia

HR Business Partner - Transport Industry

South Australia

People & Talent Acquisition Coordinator - Contract

Queensland

Organisational Development Specialist - Contract

Queensland

HR Advisor - Contract

New South Wales

A07 Senior Advisor - Integrity and Workplace Relations - Contract

Queensland

People, Performance & Culture (PPC) Systems & Reporting Analyst

Victoria

People Manager - Contract

Western Australia